What Is The Altman Z-Score?

The Altman Z-score is a metric which gauges a company’s probability of going bankrupt. The Altman Z-score is based on a formula created by NYU professor, Edward Altman. This formula is shown below.

Altman Z-score = 1.2V + 1.4W + 3.3X + 0.6Y + 1Z

Where:

V = Working Capital / Total Assets

W = Retained Earnings / Total Assets

X = EBIT / Total Assets

Y = Market Value Of Equity / Total Liabilities

Z = Sales / Total Assets

How To Analyze The Altman Z-Score

After using that formula, you will be left with a number. This number should tell you a great deal about the financial health of a company. An Altman score above 3.0 represents a very healthy company, one which is very unlikely to go bankrupt. However, an Altman score closer to 0 likely represents a very distressed company, one which is at great risk of going bankrupt.

The History Of The Altman Z-Score

The Z-score results were recently modified by Altman. Before, he believed a company with a Z-score of 1.8 was likely headed for bankruptcy. In 2007, the median Z-score was 1.81 amongst companies. This signaled to investors that bankruptcies could be on the way. Companies soon after defaulted, giving authority to the Z-score.

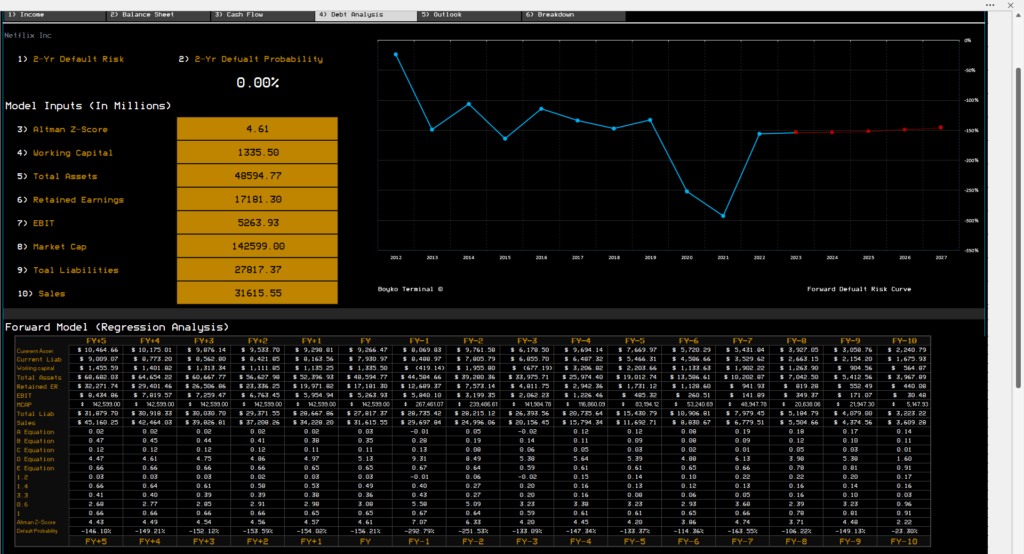

Boyko Investment Research Use Case

Boyko Investment Research uses the Altman Z-Score in calculating 2-Yr default risk probability. Equity default risk is extremely useful in optimizing portfolios and determining the fair value of a security. The equation used to calculate the default risk of a security is as follows:

dR = 1 – [ (Altman Z-Score / 0.018) / 100 ]

Conclusion

The Altman Z-score is a formula used to measure a company’s probability of going bankrupt. The formula takes into account five financial ratios to calculate a score, with a score above 3.0 indicating a healthy company and a score closer to 0 indicating a distressed company at risk of bankruptcy. The Z-score has been modified over time and is used by investment research firms like Boyko Investment Research to calculate default risk probability and optimize portfolios.