Overview of Methodology

Boyko Wealth’s Credit Ratings methodology builds upon the data that Boyko Wealth has accumulated for over two decades on companies, industries, and financial markets. Boyko Wealth’s credit rating methodology is based on company models including their expectations of future cash flows. Boyko Wealth’s corporate credit rating methodology is quantitative and model based. No human opinion is taken into account when modeling. Five key components drive the Boyko Wealth credit rating methodology and credit ratings model; these are the “pillars” of their methodology:

| Cash Flow Cushion, a set of proprietary, forward-looking measures based on their forecasts of cash flows and financial obligations. Solvency Score, a proprietary scoring system that incorporates a company’s leverage, liquidity, coverage ratios, and profitability. Distance to Default, a quantitative model that uses market-based inputs to rank companies based on their likelihood of financial distress. Business Certainty, which encompasses the proprietary Boyko Wealth Economic Moat and Uncertainty assessment, along with six other risk factors. Impacts, a variable coefficient driven by negative forces facing the company. |

A company’s scores in each of the five pillars are factored into Boyko Wealth’s final corporate credit rating. The consolidated Credit Score (CS), is their estimate of the consolidated corporation’s total capacity to meet its financial obligations as they come due and in accordance with their terms. The CS assumes that all the resources of the consolidated corporation are available to meet those obligations, including the assets of its foreign subsidiaries, its shares in joint ventures, and investments in other entities. The CS would be the rating of the ultimate parent’s senior unsecured debt, assuming that is the only class of debt; that all debt is issued by the ultimate parent level and guaranteed by all subsidiaries; and all domestic and foreign assets of the corporation were available to service that debt. Underlying this rating are a focused methodology, a robust, standardized set of procedures, and core financial risk and valuation tools. The model is a method for consistently integrating Boyko Wealth’s fundamental research across industries to produce a sensitivity analysis and model driven credit rating as a key input into a rigorous rating committee process through which the final rating is determined. The model is not paid for by external sources, nor can it be influenced by any person, company, or investment fund. CS’s are not influenced by anything other than raw data, and are paid for by Boyko Wealth to ensure consistency and to avoid fraudulent purchases of credit scores, which we believe plagues the current financial industry.

Cash Flow Cushion (CFC)

The Cash Flow Cushion ratio is a fundamental indicator of a company’s future financial health and is a component of the Boyko Wealth credit rating. This measure indicates how many times a company’s internal cash generation plus liquid assets can cover its debt-like contractual commitments over the next five years. At its core, the Cash Flow Cushion acts as an early warning system for potential financial distress, highlighting risks related to refinancing, operations, and liquidity.

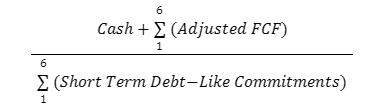

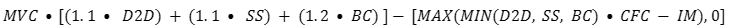

The formula for calculating the Cash Flow Cushion coefficient used by Boyko Wealth is:

This ratio focuses on assessing the company’s ability to manage interest and principal payments, including those from joint ventures if applicable, and considers other debt-like obligations such as lease payments, pension contributions, guarantees, and legal contingencies. These obligations, if unpaid, could lead to financial distress or bankruptcy. The denominator of the ratio sums up all short-term debt-like commitments expected in the next six years, while the numerator includes current cash on hand and adjusted free cash flows from the past six years.

Boyko Wealth calculates Adjusted Free Cash Flow by adding back the cash components of expense items included in net income from continuing operations that resemble debt-like contractual cash commitments. This adjustment ensures that only relevant cash expenses are considered, excluding items like maturing debt that were not initially included in net income. These adjustments are tax-effected to derive the adjusted net income from continuing operations.

The adjusted net income from continuing operations is then used to determine the adjusted cash flow from operations, with projected dividends subtracted as they represent discretionary cash outflows that reduce funds available for debt servicing. This adjusted cash flow from operations is further adjusted by subtracting total capital expenditures, asset sales/dispositions, acquisitions, and cash flows related to investments in long-term operating assets to arrive at Boyko Wealth’s assessment of the company’s adjusted free cash flow.

This approach allows Boyko Wealth to provide a assessment of a company’s financial health, identifying potential liquidity challenges and financial risks that could impact its creditworthiness over the medium term (two years).

Solvency Score (SS)

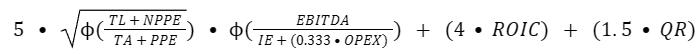

Any credit scoring system would be inaccurate to ignore a company’s financial health as described by key financial ratios. In our effort to create a ratio-based metric, we employed binary logistic regression analysis to evaluate the predictive ability of several financial ratios commonly believed to be indicative of a company’s financial health. We refer to it as the Boyko Wealth Solvency Score.

Financial ratios can describe four main facets of a company’s financial health: liquidity (a company’s ability to meet short-term cash outflows), profitability (a company’s ability to generate profit per unit of input), capital structure (how the company finances its operations), and debt-service capability (how much profit is earned per dollar of interest payments). The Solvency Score includes one ratio from each of these four categories.

Boyko Wealth continually forecasts these accounting values for future time periods and it is reasonable to assume that using estimates of future accounting values will yield more predictive results than previously reported ratios. Therefore, the Solvency Score incorporates some estimates of future ratios.

| Symbol | Explanation |

|---|---|

| TL | Total Liabilities |

| NPPE | Net PPE |

| TA | Total Assets |

| PPE | Gross PPE |

| EBITDA | Earnings Before Interest, Tax, Depreciation, and Ammonization |

| IE | Gross Interest Expense |

| OPEX | Operating Expenditures |

| ROIC | Return on Invested Capital |

| QR | Quick Ratio |

Part of the attractiveness of the Solvency Score lies in its intuitiveness. Practitioners of financial analysis recognize that each included ratio has its own ability to explain default risk. The weighting scheme and interaction between ratios appeal to common sense. For instance, it is logical to assume that a declining interest coverage ratio would strongly predict default. Even healthy companies may face challenging years where profits decline and interest coverage weakens. Thus, a multiplicative combination of the interest coverage ratio and the capital structure ratio is found to be more explanatory than either ratio individually or in a linear combination.

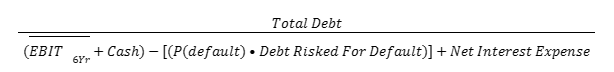

Distance To Default (D2D)

The Distance to Default metric, or D2D, is a company based measure of financial health provided by Boyko Wealth’s Equity Risk Model. This metric utilizes two primary inputs: Default Probability and Debt Obligations.

The coefficient is based upon the value of 0.50. Companies often range between 0.20 and 0.90. This scoring system helps to magnify a companies ability to pay financial obligations that could result in a primary default.

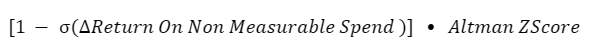

Business Certainty (BC)

Boyko Wealth calculates business certainty from the return on non-measurable spend. This includes Goodwill, Intangible Assets, and Research & Development (R&D). This return is calculated as the sum of Goodwill, Intangible Assets, and R&D; divided by total Free Cash Flow. Return on non-measurable spend is calculated for the prior five years, and the percent change between each year is taken. The business certainty coefficient is calculated as the standard deviation of these percent changes greater than one; multiplied by the Altman Z-Score provided by the Boyko Risk Model.

This coefficient demonstrates the companies consistency in utilizing non-standard methods to create Free Cash Flow. Finally it takes into account the stability of the business to output a coefficient.

Impacts (IM)

Impacts are aspects of the business that hinder the companies ability to create value. These impacts modeled, generate a coefficient that is subtracted from the CS at the end of the model.

| Impact | Description |

|---|---|

| Cost of Selling | (COGS + OPEX) / Sales |

| Current Industry Liquidity | Measure of business liquidity in the industry |

| Debt Term | Debt Term Ratio (Greater Than One Year) |

| Invested Capital Inefficiencies | Retained earnings inefficiency to total equity |

The impact coefficient is the sum of all impacts and is used as a negative gauge on the business. Severe impacts can cause a companies credit rating to fall.

Market Valuation Effects (MVC)

A companies size plays a crucial role in validating the effectiveness of the Boyko Wealth Credit Rating. Large companies are more adaptable to market change, and are often the last companies to default. A coefficient is assigned to the model when building the credit score to represent the companies market valuation. These coefficients are scaled as followed.

| Market Valuation (US Dollars) | Coefficient |

|---|---|

| 200 Billion | 1.50 |

| 10 Billion | 1.00 |

| 2 Billion | 0.90 |

| 300 Million | 0.88 |

| 100 Million | 0.70 |

| 50 Million | 0.60 |

| 20 Million | 0.55 |

| 10 Million | 0.50 |

Credit Score (CS)

The Credit Score (CS) is the crucial final component of the model which translates the previous information into a useable and comparable score for all companies. The CS is calculated as the difference between positive impacts of business and the cashflow adjusted negative impacts of the business.

This score represents Boyko Wealth’s model output, and allows for easy comparison between companies. This process standardizes companies financial health in relation to external forces. This allows for a credit rating to be assigned.

Credit Rating

The credit rating is a means of effectively differentiating between “investment grade” and “non-investment grade” companies. Boyko Wealth’s credit rating system utilizes a similar scale as the industry, with “BBB” being the final tier of investment grade. The scale is as follows.

| Credit Rating | Credit Score |

|---|---|

| AAA | 25 |

| AA | 15 |

| A | 9 |

| BBB | 5 |

| BB | 0 |

| B | -2 |

| CCC | -5 |

| D | -10 |

It is important to note, receiving a “D” credit rating, is a demonstration that a company has defaulted or is expected to default in the next two years. The probability of each credit rating can be found below.

Notice

The model is subject to change. Boyko Wealth will update documentation within thirty days of a change. If you would like to receive notifications of such a change, please get in contact with your representative. If you have any questions regarding our methodology, please reach out to Brayden Boyko:(braydenboyko@boykowealth.com)