Stock screeners are an easy way to quickly sort and filter information to find companies that are worth taking a deeper look at. We will look at different criteria and common screeners that make it easier to locate your specific criteria when researching companies.

Two common screeners are Finviz and Tradingview. This tutorial will be using Finviz.

How to use a Screener

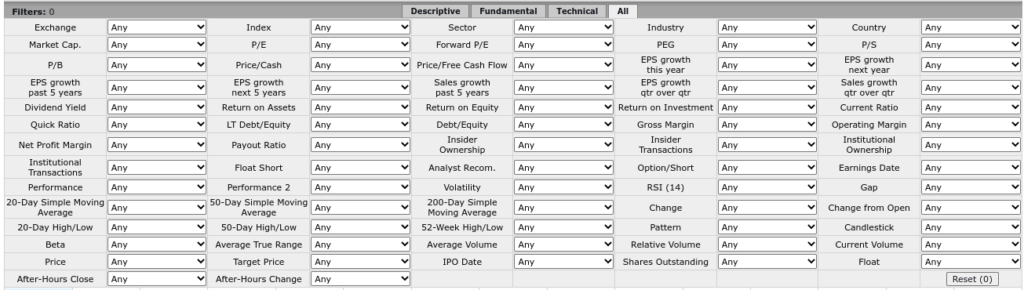

On most stock screeners, you’ll find three sections: The filters, the results, and settings. You can manually adjust the filters to search for specific companies that will show in your results page. You can then change the settings to show different company information about the companies that are filtered into your results page.

The filters:

*For a detailed description of each of the filters, and what they tell about a company, read “The Complete Guide To Stock Ratios”

- An example of one of the filters is Debt/Equity

Debt/Equity is a calculation of the amount of liabilities a company has as a percentage of its equity. It is calculated by dividing liabilities by shareholder equity. Debt/Equity can be used to show the amount of leverage that a company is taking on in order to generate revenue. Warren Buffett preferred seeing companies with a debt/equity ratio of less than .80, but he was aware that companies generating large cash flows could sustain higher amounts of liabilities (debt).

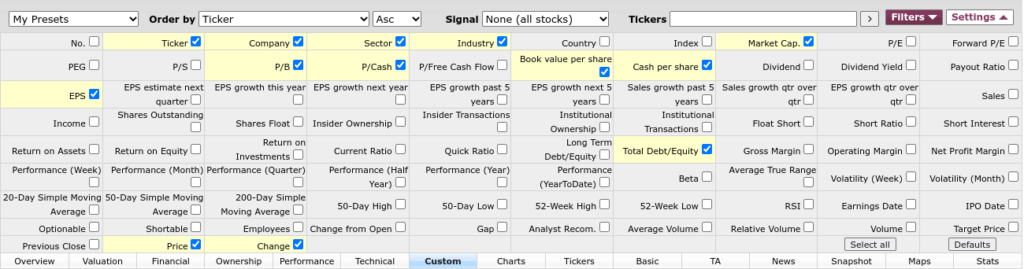

The settings:

Adjusting the settings changes which filters and company information is shown on the results page.

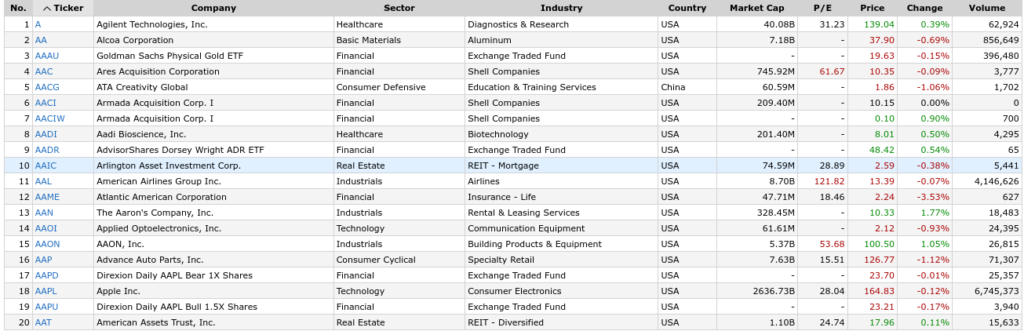

The results:

Each of the columns of the results show one of the settings that we marked to be shown on the settings page. You can interact with the results page to find more company information and ratios, or you can paste the ticker into an SEC search. On finviz, you can find hyperlinks to Yahoo Finance and the SEC EDGAR search below the “Insider Trading” tab.

Now it’s time to talk about how you can use these screener sections to search for companies to buy.

The following screener setups will be discussed below: Deep Value Plays, Solid Cash Flow Companies, Earnings Volatility Arbitrage, Biotech Puts

Deep Value Setup

Keith Gill, one of the prominent investors of the Gamestop short squeeze in ‘21, looks for: Semi-liquid companies trading near their 52 week low, with low Price to tangible Book ratio, high insider trading, and a small market capitalization. These companies are often volatile, but have a margin of safety due to their relatively high book value. He weighs insider trading very heavily in his evaluation and looks for clustered insider buying with acquisitions of $500k or more.

To screen for stocks with these characteristics, set the following filters:

Market Cap. = -Small (under 2bln)

P/B = Low(<1)

52 Week High/Low = 0-10% above low

Average Volume = Over 200k

Insider Transactions = Very Positive (>20%)

You can also use openinsider.com to find companies with clustered insider buying.

Solid Cash Flow companies

Seth Klarman outlines in “Margin of Safety” that the three ways to value a company are through private liquidation values, market caps of similar companies, or through finding the net profit value of its discounted cash flows. You can find our tutorial for discounting cash flows here. This screen evaluates the price as a ratio of the free cash flow generated by a company (p/fcf). It is a good starting point for finding stocks to create a Discounted Cash Flow Model. It also uses the Relative Strength Index to find oversold companies, and a low price to book value to find possible companies that could have realizable asset value. Finviz also has the ability to find if a company has outstanding options, which presents a chance to find Long-term Equity Anticipation Securities on companies that are generating strong free cash flows. To screen for stocks with these characteristics, set the following filters:

P/B = Low(<1)

Price/Free Cash Flow = Low(<15)

Average Volume = Over 200k

Option/Short = Optionable

RSI (14) = Oversold(40)

Some of the screener data may be outdated or incorrect on Finviz, so it is important to analyze the company’s financial statements to verify any screener data

Earnings Volatility Arbitrage

Many large companies have an earnings “hype” before they release their quarterly earnings. A possible trading strategy is to sell options for a higher implied volatility than their historical earnings volatility. It is important to note that using this strategy could expose the trader to unlimited loss if they were to sell a naked call option, and have it be exercised. This strategy bets that the earnings volatility will likely regress toward the average volatility of the company during its past earnings reports. The screener filters search for large companies with an overbought RSI, and an upcoming earnings date. To screen for stocks with these characteristics, set the following filters:

Market Cap. = +Small (over $300mln)

Average Volume = Over 1M

RSI (14) = Overbought(60)

Relative Volume = Over 1

Earnings Date = Next 5 days

Current Volume = Over 1M

Implied and historical volatility on options can be found on the website: marketchameleon.com

Biotech Puts

Biotechnology research companies spend millions of dollars developing drug candidates to undergo trial testing by the National Institute of Health (NIH). According to the NIH, nearly 90% of these biotech companies fail in the clinical trial phases. One strategy to play this statistic is to buy put options against biotech research companies that have drugs in the testing pipeline. Again, you will want to find options that are trading implied volatility at a significant discount to the historical volatility. The price/cash filter helps to search for companies that have raised significant funding to help develop their treatments. To screen for stocks with these characteristics, set the following filters:

Price/Cash = Under 1

Sector = Healthcare

Option/Short = Optionable

Conclusion

By using the article, you should now be able to more efficiently pre-screen stocks to conduct due diligence on. Stock screeners are like any financial tool; they are only as strong as the user and data inputs.

None of these strategies are recommendations, and you should complete your own due diligence before buying any security.